For Regular Latest Updates Please Follow Us On Our WhatsApp Channel Click Here

Last updated on October 7th, 2024 at 02:21 am

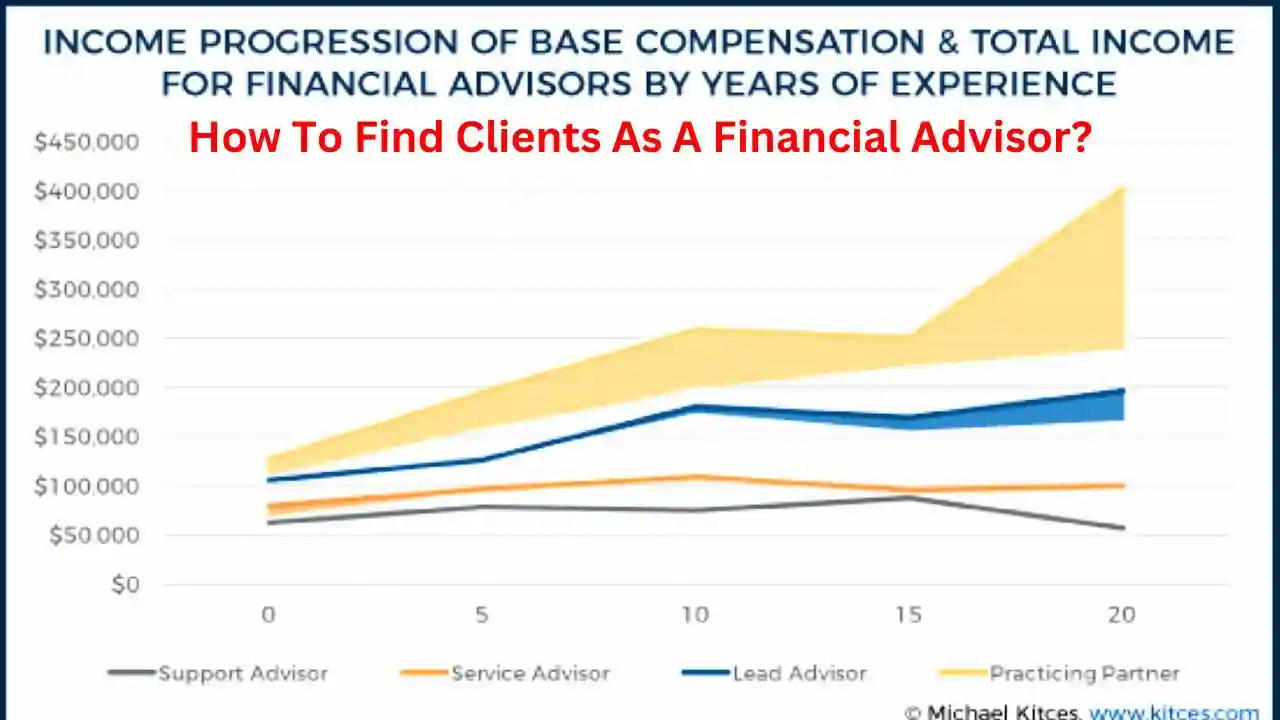

Building a client base as a financial advisor requires a strategic approach that combines relationship-building, marketing, and expertise.

For Regular Latest Updates Please Follow Us On Our WhatsApp Channel Click Here

Here are some effective strategies to understand how to find clients as a financial advisor:

Networking and Relationship Building: [How To Find Clients As A Financial Advisor In 2024]

Leverage Your Existing Network:

Reach out to friends, family, and former colleagues.

Attend Industry Events:

Connect with potential clients and other professionals at financial conferences and seminars.

Join Community Organizations:

Volunteer and participate in local events to build relationships.

Referrals: [How To Find Clients As A Financial Advisor In 2024]

Encourage satisfied clients to refer you to their friends, family & contacts.

Digital Marketing: [How To Find Clients As A Financial Advisor In 2024]

Build a Strong Online Presence:

Create a professional website and have it optimized for search engines (SEO).

Utilize Social Media:

Share valuable content, engage with your audience, and build trust.

Content Marketing:

Produce informative articles, blog posts, or videos to attract potential clients.

Email Marketing:

Nurture leads and stay connected with your audience through email campaigns.

Niche Down: [How To Find Clients As A Financial Advisor In 2024]

Identify Your Target Market:

Focus on a specific demographic or client type to tailor your services.

Develop Expertise:

Become a trusted authority in your chosen niche/sector.

Build Relationships:

Network with professionals in your target market.

Client Acquisition Strategies: [How To Find Clients As A Financial Advisor In 2024]

Cold Outreach:

Proactively reach out to potential clients through phone calls, emails, or social media.

Paid Advertising:

Consider using platforms like Google Ads or social media advertising to generate leads.

Partnerships:

Collaborate with other professionals, such as accountants or lawyers, to cross-promote services.

Free Consultations:

Offer initial consultations to demonstrate your expertise and build rapport.

[Also Read: LLMs In Fintech: The Huge Potential 2024]

Additional Tips:

Provide Exceptional Service:

Deliver value to your clients and exceed their expectations.

Focus on Client Retention:

Build long-term relationships with your clients.

Continuous Learning:

Stay updated on financial trends and industry best practices.

Measure Your Success:

Track your marketing efforts and adjust your strategy accordingly.

Remember: Building a successful financial advisory practice takes time and effort. Consistency, patience, and a client-centric approach are essential for long-term success.

Frequently Asked Questions (FAQs) On Financial Advisor / Investment Advisor Answered Here:

How to become a Financial Advisor without a Finance Degree?

Becoming a Financial Advisor Without any Finance Degree

While a finance degree can be beneficial, it’s not a strict requirement to become a financial advisor.

Many successful advisors come from diverse backgrounds. Here’s a roadmap to get you started:

Build a Strong Foundation:

Financial Literacy: Develop a deep understanding of personal finance, investing, taxes, insurance, and retirement planning.

Industry Knowledge: Stay updated on market trends, economic indicators, and regulatory changes.

Soft Skills: Cultivate strong communication, interpersonal, and problem-solving skills.

Obtain Necessary Licenses:

Series 6 or 7: These licenses authorize you to sell securities.

Series 63 or 65: These licenses cover the Uniform Securities Agent State Law Examination (Series 63) or the Uniform Investment Adviser Law Examination (Series 65).

State-Specific Licenses: Depending on your city/location, you could need additional licenses.

Gain Experience:

Entry-Level Positions: Consider roles in customer service, sales, or administrative positions within financial firms.

Internships: Seek internships at financial advisory firms to gain practical experience.

Mentorship: Find a mentor in the industry to properly guide your career path.

Continuous Learning:

Certifications: Consider certifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA) to enhance your credibility.

Online Courses: Utilize online platforms to learn about investment strategies, financial planning, and market analysis.

Industry Events: Attend conferences and seminars of the industry to stay updated on the latest industry updates & trends.

Build Your Network:

Networking: Connect with other financial professionals, potential clients, and industry experts.

Online Presence: Create your own professional website and social media profiles to display/showcase your expertise.

Specialize:

Niche Market: Consider specializing in a specific area, such as retirement planning, estate planning, or wealth management.

Remember: Building a successful career as a financial advisor takes time and dedication. Focus on providing exceptional value to your clients, and your reputation will naturally grow.

How do you become a Registered Investment Advisor?

Becoming a Registered Investment Advisor (RIA) in the US involves several key steps:

Meet the Educational and Licensing Requirements:

Series 65 Exam: This is the most common exam for becoming an investment advisor representative (IAR), the individual who works for an RIA. However, some states accept other combinations of exams (like Series 7 and Series 66).

State-Specific Requirements: Some states have additional licensing or registration requirements.

Consider Additional Certifications: While not mandatory, certifications like Certified Financial Planner (CFP), Chartered Financial Analyst (CFA), or Certified Public Accountant (CPA) can enhance your credibility.

Form a Business Entity:

Choose a Business Structure: Decide on the structure of your RIA (sole proprietorship, partnership, LLC, corporation).

Register Your Business: Obtain necessary licenses and permits for your business.

Develop a Business Plan:

Define Your Target Market: Identify the clients you want to serve.

Outline Services: Determine the investment services you will offer.

Set Fee Structure: Decide on your compensation model (fee-only, commission-based, or hybrid).

Create a Marketing Plan: Develop strategies to attract clients.

Register with the SEC or State:

SEC Registration: Required for RIAs with assets under management (AUM) exceeding $100 million (or in some cases, lower thresholds).

State Registration: Required for RIAs with AUM below the SEC threshold or those with specific state requirements.

Form ADV: Complete this comprehensive registration form that discloses information about your business, services, fees, and conflicts of interest.

Establish Compliance Procedures:

Create Policies and Procedures: Develop internal guidelines for handling client information, investments, and conflicts of interest.

Implement Recordkeeping: Maintain detailed records of client transactions, communications, and investment advice.

Obtain Necessary Insurance:

Professional Liability Insurance: Protects your business from all kind of claims of errors or omissions.

Other Coverages: Consider additional insurance like cyber liability or property insurance.

Build Your Client Base:

Network: Develop relationships with potential clients and industry professionals.

Marketing: Utilize your marketing plan to attract clients.

Provide Exceptional Service: Build trust and referrals through excellent client service.

Important Considerations:

Fiduciary Duty: RIAs are held to of a fiduciary standard, meaning they must professionally act in the best interest of their clients.

Compliance: Adherence to regulatory requirements is crucial.

Ongoing Education: Stay updated on the latest industry trends, updates and the latest regulatory changes.

Remember: Becoming an RIA is a complex process. It’s advisable to consult with legal and financial professionals to ensure compliance and navigate the regulatory landscape effectively.

Additional Resources:

For Regular Latest Updates Please Follow Us On Our WhatsApp Channel Click Here